If your business is lending money or providing services on credit, you know how important it is that you get paid for your hard work. When creditors are unable to collect on account balances, they often need to rely on professionals like collection agencies, law firms or debt buyers to recoup as much as possible from their distressed and charged off accounts.

When creditors need immediate cash flow, they may sell their delinquent or charged-off accounts to an investment firm that specializes in purchasing and managing distressed assets. These investment firms are often known as “debt buyers”. Debt buyers purchase the accounts from the creditor for cash, then use their systems and processes to attempt to collect the outstanding debt.

When creditors choose to sell debt, it is important that they choose the right debt buyer partner. Finding the right debt buyer to work with can be the key to sustainable growth while the wrong choice can cause reputational and financial damage. That is why it is critical for creditors to find a debt buyer that shares a mutual commitment to the highest compliance standards and consumer experience. Here, we share 6 items creditors should look for when selecting a debt buyer partner.

1. Experienced Leadership

Finding an experienced management team that understands the details of collections and recovery processes is essential to driving performance and creating a sustainable relationship. Seasoned executives who have established relationships and a strong service provider network can make all the difference in a successful partnership. Executives should have a thorough understanding of industry best practices, established policies and procedures, integrated technology systems and a deep understanding of how to implement them with long-term success.

2. RMAI Certification

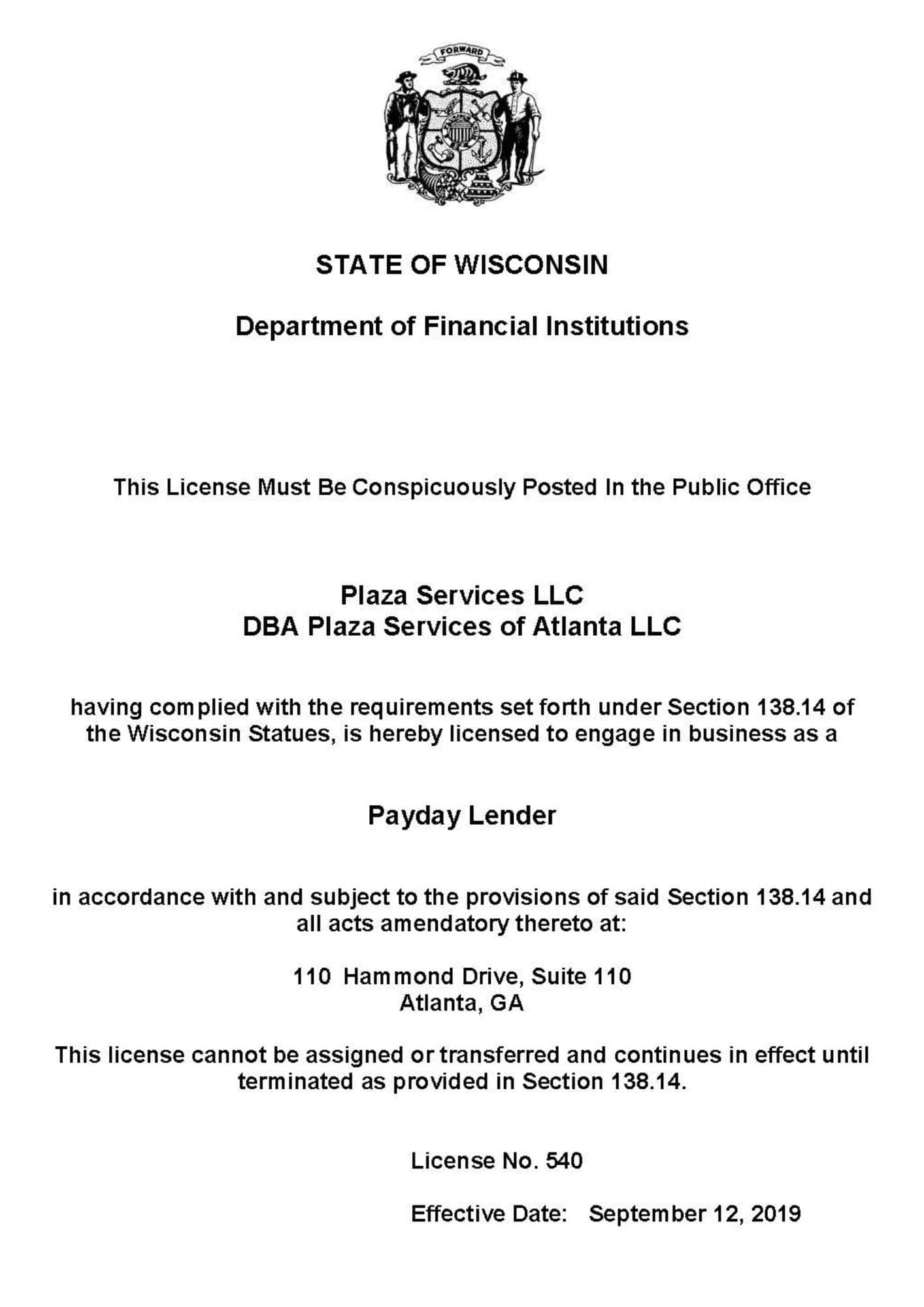

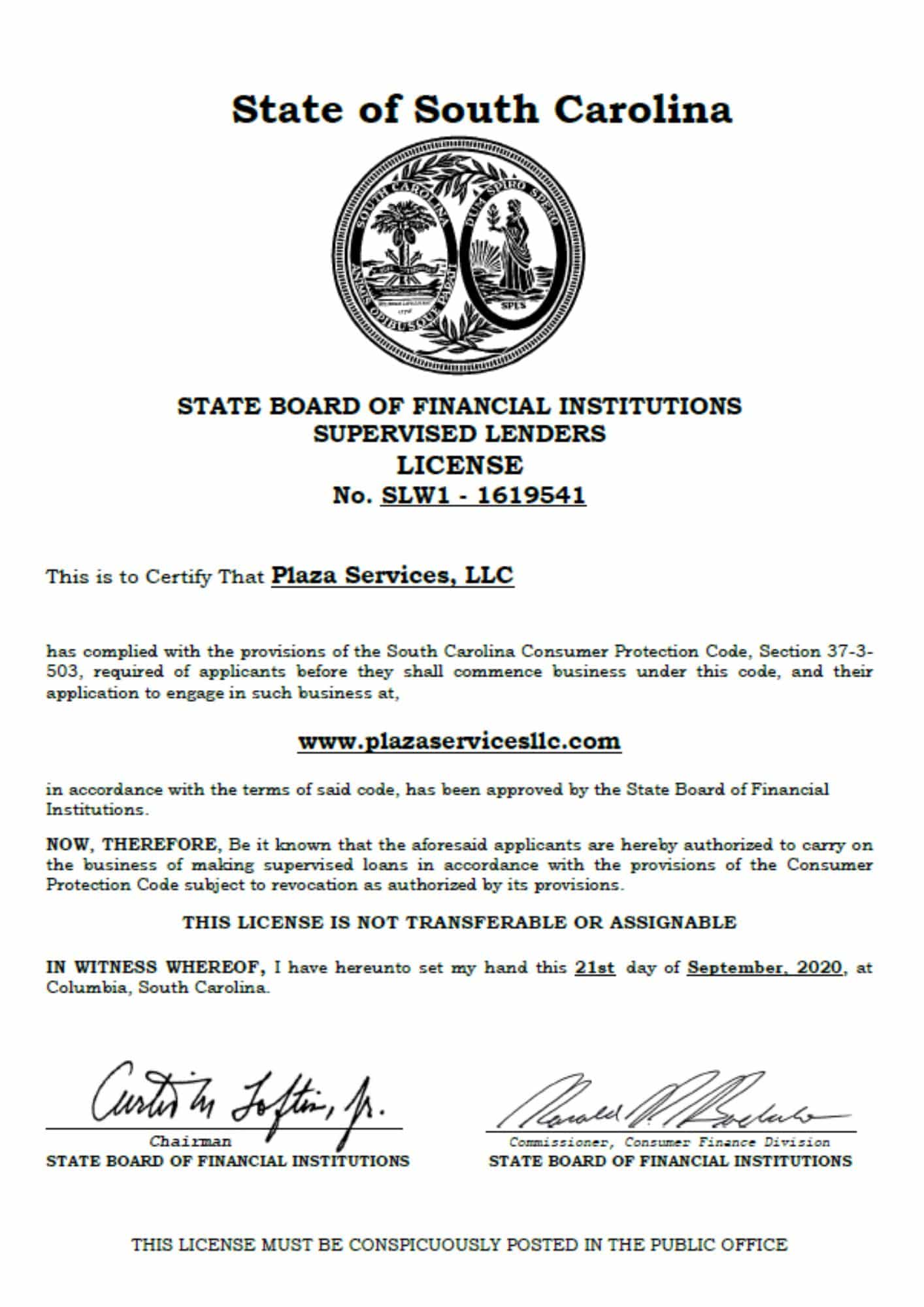

Receivables Management Association International certifications are referred to as the gold standard in receivables certification due to requirements that go above and beyond what is required by law. Industry trade association certifications demonstrate a command of industry standards as well as a commitment to a set of best practices. Plaza Services is an RMAI Certified Receivables Business (CRB) and consistently demonstrates compliance with certification standards to third-party auditors as per the standards of RMAI certification.

3. Compliance Systems

Not all compliance systems are created equal. When considering a debt buyer, creditors should look carefully at the technology, processes, and systems that manage compliance-related tasks and understand how they are managing compliance both internally and externally with service provider networks. Potential debt buyers need a strong compliance management system that ensures compliance with laws, regulations, and reporting requirements, reducing risk and increasing performance. Compliance programs should have methods for identifying trends and providing intelligence for proactive recovery management.

4. Industry Participation

Regulation of the receivables management industry is complicated and constantly changing.

Industry associations are an important part of staying informed of changes and helping to interpret how changes will affect operations. Membership in these associations demonstrates the commitment to a set of industry values and standards of excellence. Industry associations provide access to continuing education, advocacy efforts, updates on new legislative rulings, information on technological advances, and more. By attending events and conferences, members are better informed and more visible within the receivables industry’s extensive network.

5. Data Security & Privacy

Data security and privacy are not only a business and legal requirement, but also the key to both the creditor’s and debt buyer’s success. Creditors should review evidence of protective measures that demonstrate the company’s commitment to keeping data safe and secure. Creditors should want to understand how data is managed and stored. Data security certifications like SOC II, PCI-DSS, or others.

6. Creditors Care About Price

This list would not be complete without acknowledging that price is also a factor in choosing the right debt buyer. The value of getting the right price for your assets cannot be overlooked, but it should be just one of the factors you use to select your partner. Price has an obvious impact on the value of selling charged-off accounts, but compliance complaints, data breaches, and mismanagement of inventory can add up to a big cost.

Creditors and their debt buyer partners benefit from developing longer-term partnerships. It is crucial to take the time to evaluate potential partners and pick the one that is best fit. When selling accounts to a debt buyer, the creditor is creating a relationship and the two parties are going to need to communicate in the future for document requests and to address other items as they arise.

About the Author

Adam Parks is a serial entrepreneur in the receivables management space working with a mix of creditors, debt buyers, and collection agencies as an advisor, investor, and founder. Adam’s experience ranges from debt brokerages, consulting firms, technology providers, and compliance management services. Adam Parks About Plaza Services currently serves as the Chief Marketing Officer for the RMAI certified debt buyer Plaza Services, LLC based in Atlanta, GA.