Reimagining Debt Through Education

Debt often feels complex, confusing, and isolating when consumers are contacted by a company they’ve never heard of, about a debt they may not fully understand. Recognizing this challenge, Plaza Services, an Atlanta-based, RMAI-certified receivables management firm. Plaza Services recently launched a dedicated YouTube channel to bring clarity to the process. The goal is simple: to demystify debt resolution and help consumers better understand their rights, responsibilities, and next steps when an account has been acquired by a third-party firm like Plaza Services.

Plaza Services at a Glance

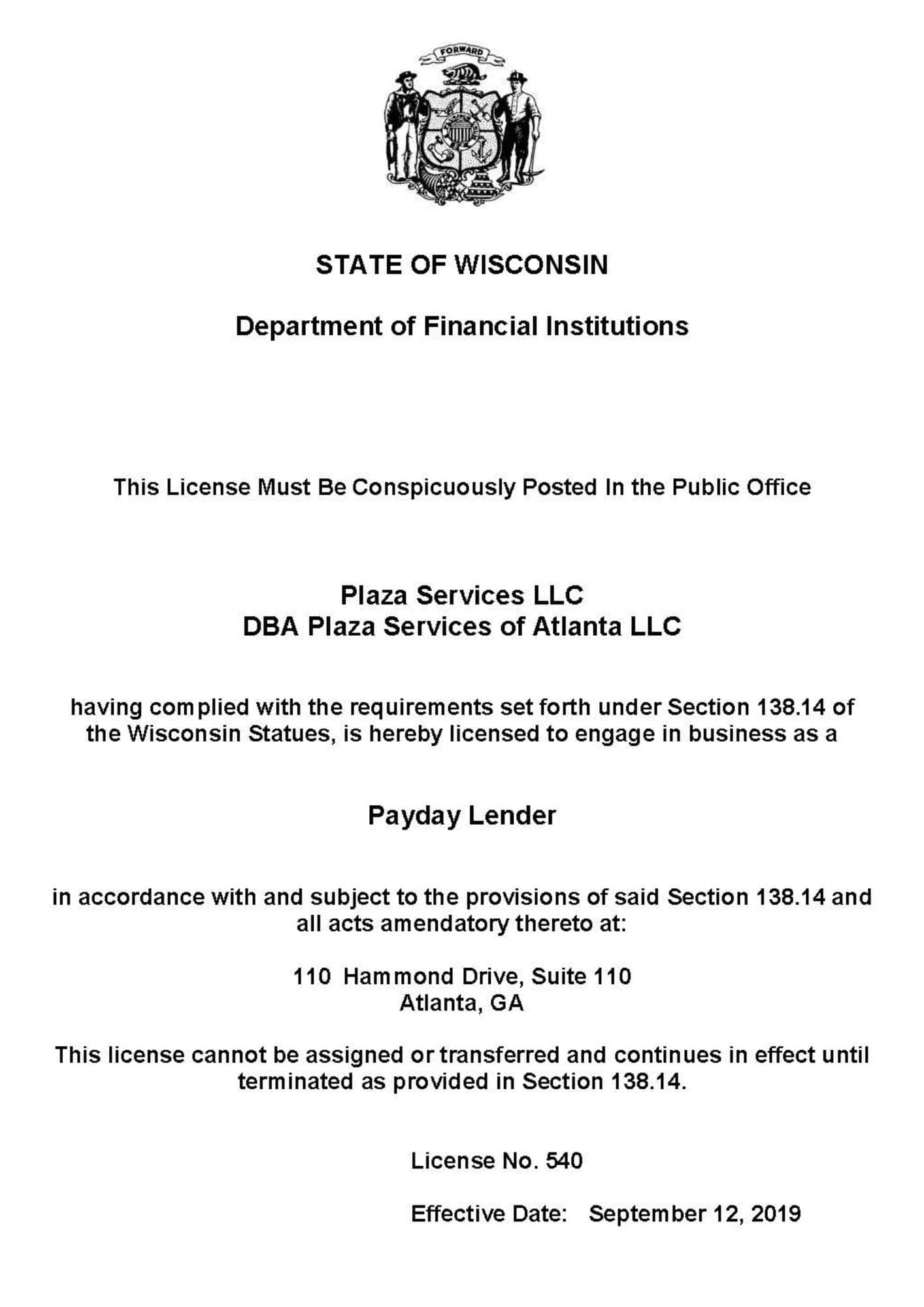

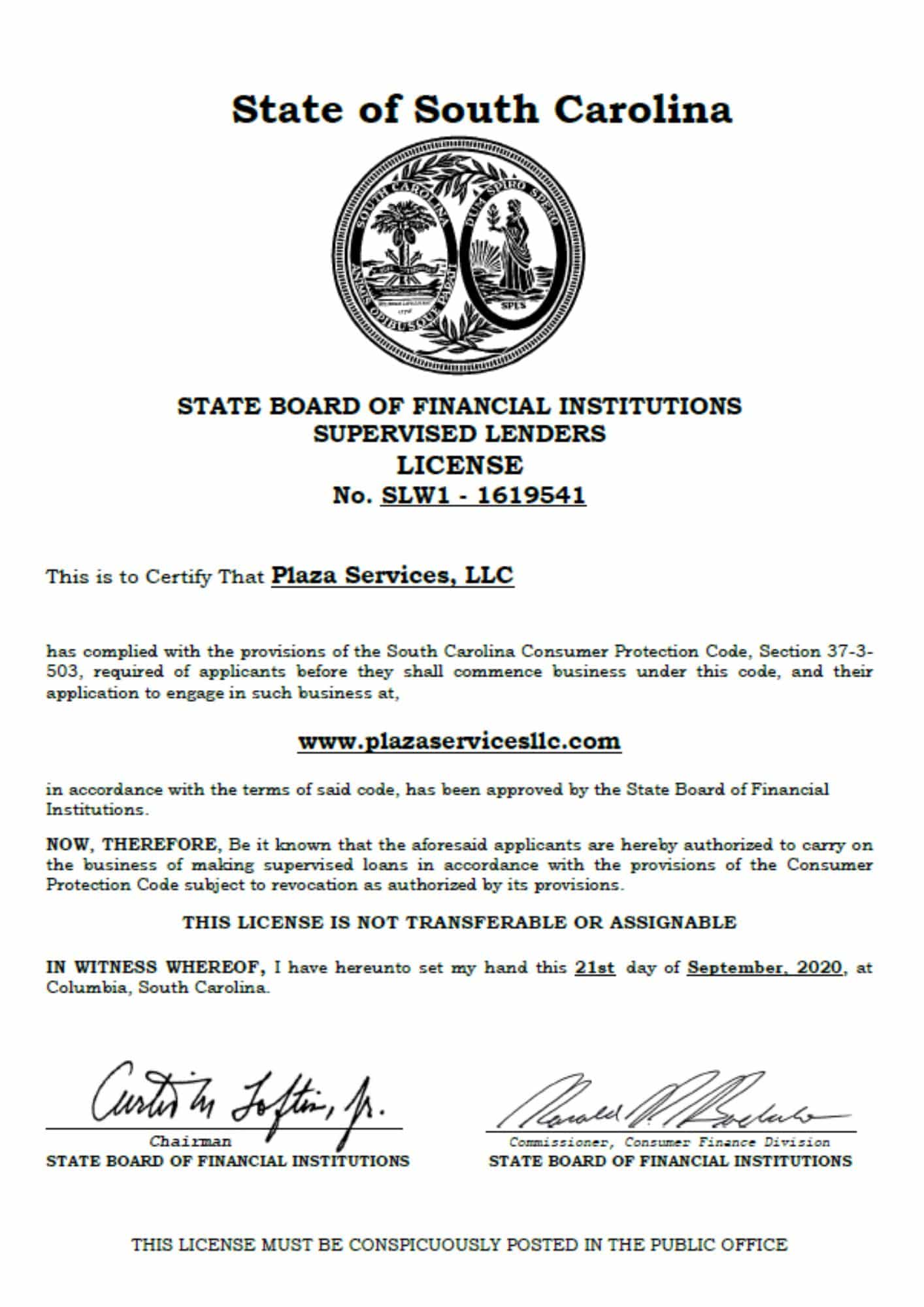

Plaza Services specializes in managing acquired consumer credit portfolios, guiding individuals toward resolution with transparency and sensitivity. The company holds both RMAI certification and SOC 2 Type 2 attestation, reflecting a firm commitment to data security, ethical practices, and legal compliance—foundations that underpin all its public-facing educational efforts.

Reaching Consumers on Their Terms

Plaza Services began developing video-based content to support consumers who might have discovered Plaza Services has purchased their outstanding credit account. Recognizing the need for immediate clarity, the channel offers concise, consumer-centric content tailored for those encountering debt-related notices for the first time.

Each video runs between 2 and 5 minutes—short enough to watch during a commute, quick lunch break, or a single sitting.

What’s Streaming: Key Video Themes & Topics

Plaza has organized its consumer education series into five recurring topic clusters:

Identifying the Debt Owner

- Videos like “What to Do If You Have Been Contacted by Us” explain how Plaza Services may legally communicate with you, who they are, and what collection notices might mean—offering clear next-step options and contact avenues.

- There are also videos introducing viewers to the business model, acquisition process, and legal background behind third-party debt buyers.

Credit Reporting Clarity

- Videos like “Why Is Plaza Services on My Credit Report?” visualize how accounts are listed with TransUnion, what each credit‑report line means, and how to assess its impact on your credit score.

- Other video resources focus on disputes, timelines, and next steps after resolution, emphasizing consumer rights and transparency.

Fair Collection Practices

- A Public Service Announcement-style video outlines how Plaza adheres to the Fair Debt Collection Practices Act (FDCPA). It describes permissible contact hours, information validation, and respect for privacy—reassuring viewers of a professional, regulated approach.

Payment Guides

- Videos of this category provide a step-by-satep look at Plaza’s online portal, billing options (credit card, check, money order), and how to schedule a payment securely. They aim to reduce uncertainty and frustration during reconciliation.

Company Values & Community Involvement

- Some videos communicate Plaza’s broader commitment to CSR, including support for veterans, children’s advocacy, and animal welfare. These help viewers see the company’s ethical footprint beyond debt collection.

Why These Videos Matter

What makes Plaza Services’ YouTube videos especially effective is their straightforward, consumer-friendly approach. Each video is crafted using everyday language that avoids legal jargon, helping viewers easily grasp complex financial concepts. This simplicity fosters immediate empowerment—consumers no longer feel stuck or overwhelmed, but instead gain the clarity and confidence to take their next steps.

Plaza’s transparency further reinforces that confidence. By openly sharing its RMAI and SOC 2 certifications and adherence to FDCPA guidelines, Plaza builds trust with viewers who may be unsure about the legitimacy of a debt or how to handle it.

In addition to being informative, the videos are also highly accessible. They’re available on demand, making it easy for people to watch them at their convenience—especially helpful for those who work variable hours or may have missed a mailed notice. Importantly, the tone of the videos is calm and supportive. Rather than using scare tactics or pressure, Plaza Services focuses on educating and guiding consumers through their options, creating a respectful and empowering experience throughout the debt resolution journey.

In Action: How a Viewer Might Use Plaza’s Videos

- A consumer receives a letter from Plaza and Googles [“Plaza Services on credit report”].

- They find the credit‑report video and gain clarity: “It looks like ‘Open Date’ reflects the acquisition date, not when I stopped paying.”

- They’re still uncertain about payment and watch a “What to Do If Contacted” video to choose between disputing or paying.

- Deciding on payment, they follow the walkthrough video showing the online portal, easing the process.

- After resolving the balance, online credit reporting tutorials explain how and when updates may appear on future credit reports.

- That person shares the video link with a friend also facing collection confusion.

Conclusion

Plaza Services’ YouTube channel reflects a new generation of debt‑management strategy—one rooted in education, transparency, and consumer agency. By integrating clear visuals, plain‑spoken language, and legal context, the firm helps viewers see debt resolution as a process instead of a crisis.

At a time when financial transparency is more critical than ever, Plaza’s videos serve as a bridge—transforming uncertainty into understanding and frustration into empowerment.