Adam Parks, Chief Marketing Officer of Plaza Services and entrepreneur, was featured on a recent episode of the Tech on Reg podcast, “A Receivables Tech Entrepreneur.” His conversation with host and attorney Dara Tarkowski focused on compliance, technology, and future opportunities within the accounts receivable management (ARM) industry.

Changes in Regulation & Evolving Processes

The creation of the CFPB spurred changes to processes and procedures within the ARM industry and increased the need for compliance-related technologies. Mr. Parks shared his viewpoint on how Plaza Services and the rest of the industry have successfully adapted to the CFPB’s rules and regulations and how they continue to evolve in the midst of regulation changes. He also discussed how compliance technology helps organizations offset additional expenses while delivering better data security.

The Growing Role of Technology in Compliance

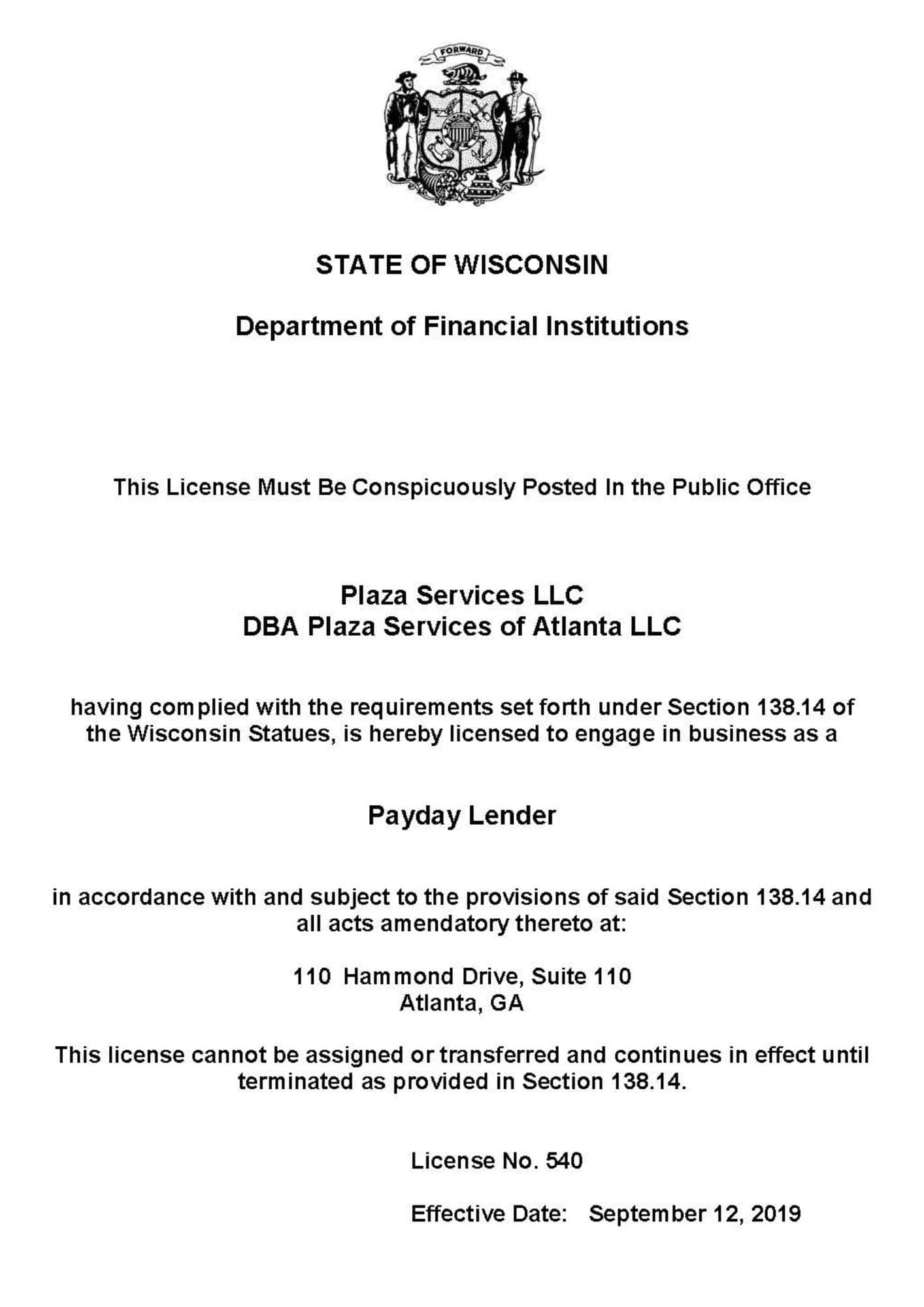

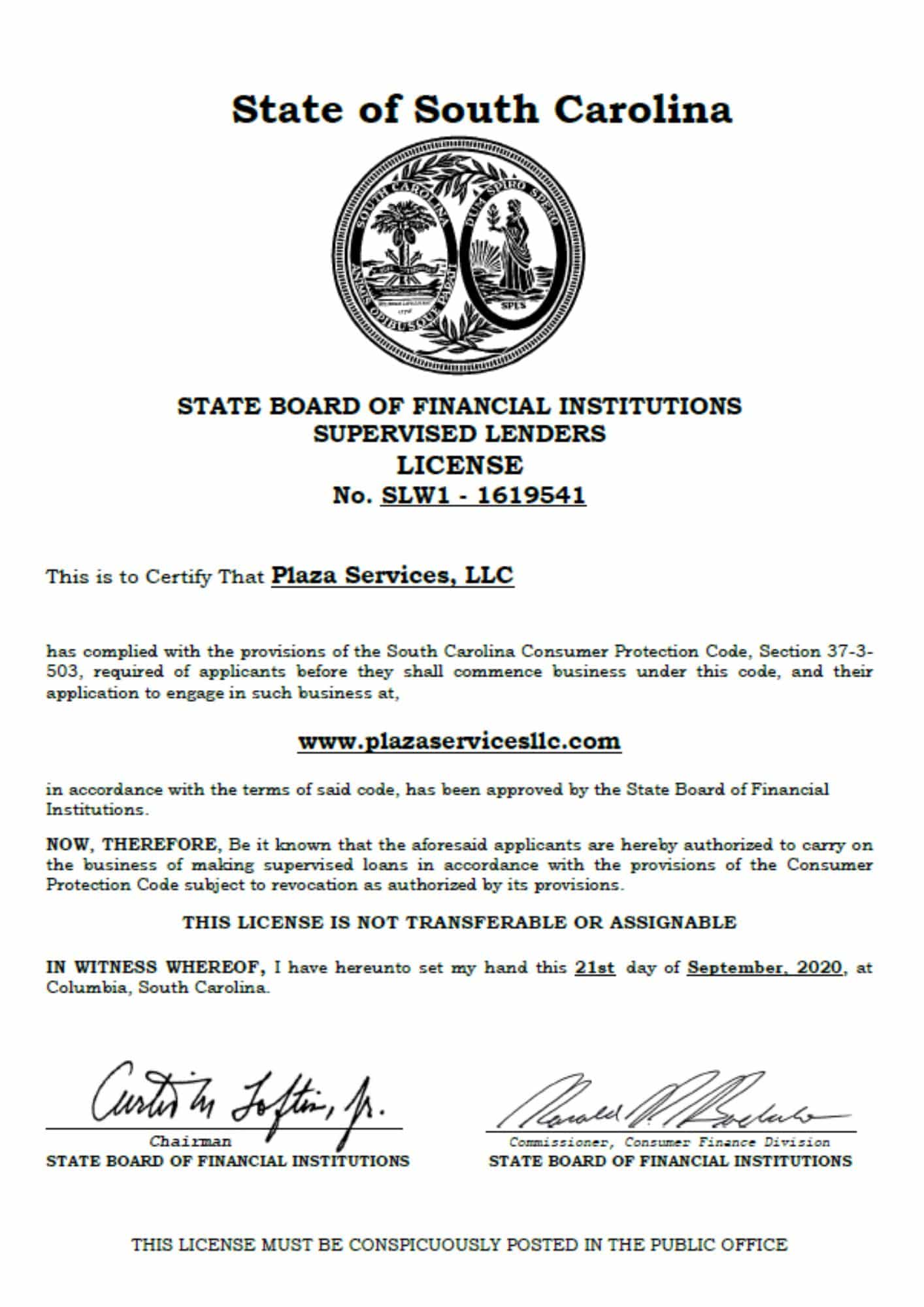

Increasing regulations and a decreasing tolerance for mistakes have made compliance a thriving industry, particularly in the accounts receivable industry. As individuals and organizations embrace compliance innovations, the quality of compliance improves. With a wide mix of separate legal jurisdictions in the United States (each potentially requiring a license), Mr. Parks addressed how debt buyers, creditors, and their service providers (attorneys, collection agencies, data providers, etc.) are increasingly turning to compliance management platforms such as ComplyARM to create efficiencies, automate licensing processes, and reduce risk.

Recognizing the Importance of Certification

In the podcast, Adam shares how Receivables Management Association International, a trade group specifically dedicated to the receivables space, created globally recognized certification programs to demonstrate to regulators and legislators its members’ commitments to holding themselves and peers accountable to standards and requirements that go above and beyond what is required by law. Referenced on various government documents and praised by the FCC, RMAI certification programs are often referred to as the “gold standard” of certifications for collection agencies, debt buying companies, collection law firms, and brokers.

Two Areas of Future Opportunity

When asked about where future opportunities lie, Mr. Parks shared his thoughts on two areas within the receivables industry: the movement of data and the consumer experience. As data is transferred back and forth between parties, technology can automate processes and ensure the integrity and security of data through clean and clear transfers. It can also replace human interaction as it is allowable, acceptable, and technologically feasible to provide more consistent and compliant services.

While the consumer experience may not appear to be directly related to compliance, compliance tools and innovative technologies create consistency in consumer communications. The better the experience is for the consumer, the less likely they are to have a complaint or need some resolution that requires the involvement of a government entity. By utilizing allowable technologies such as AI, companies can remove much of the risk by reducing the chances for mistakes through either human error or abusive and harassing phone calls.

Allowing consumers to access account services over the internet through features such as online statements, online payments, the ability to download key documents, and setting up payment plans makes the process smoother and clearer for consumers. In addition, web designers such as Branding Arc specialize in consumer-centric, compliant, and accessible websites for organizations in the receivables industry. By integrating a consumer complaint portal directly into the website design, complaints can be sent to a centralized database and directed to the right person at the organization, providing a more efficient complaint resolution process and better consumer experiences.

“It was an honor to talk with Dara and be featured on the Tech on Reg podcast,” says Adam Parks. “Compliance is a critical topic in our industry today and it’s important to share and discuss the innovations and technologies that are positively impacting consumers and helping to mitigate risk by creating efficiencies within the ARM industry.”

To listen to the “A Receivables Tech Entrepreneur” podcast in its entirety, please visit the Tech on Reg website.

About Adam Parks

Adam Parks is an entrepreneur with more than 15 years’ experience in the receivables management industry. His diverse background includes portfolio purchasing and trading as well as the development of systems and technology to manage the servicing of accounts. Adam has held various marketing and operations positions within the ARM industry brokerages which give him a broad set of experiences and relationships. Adam is the CMO of debt buyer Plaza Services, a founding partner of digital marketing firm Branding Arc, and a founding partner of ComplyARM, a leading compliance consulting firm which was sold to Provana in 2019 where he currently serves as an Executive Advisor. He also currently serves as President-Elect on the Receivables Management Association International (RMAI) Board of Directors and is on the Board of Directors for the veteran’s charity Naked Warrior Project.

About Plaza Services, LLC

Plaza Services, LLC is a consumer-centric accounts receivable portfolio investment firm committed to providing creditors with maximum value for receivables portfolios in a fully compliant manner while maintaining the highest ethical and legal standards. Plaza Services takes an empathetic approach to the recovery of accounts. Based in Atlanta, GA, the Company was founded in 2013.