The dynamic landscape of digital lending introduces unique challenges for fintech creditors, one of which is the inevitable occurrence of delinquencies and charge-offs. Delinquencies and charge-offs represent a financial strain for any lending institution. Although complex, this issue can be effectively tackled with the right strategies.

We’ll delve into four available approaches to managing past-due accounts in the fintech space, keeping in mind that consumers often prefer online interaction— particularly in the case of online-originated lending.

1. Embrace comprehensive data analysis

As we navigate the vast sea of digital information, data emerges as an invaluable compass, guiding us toward effective decision-making and risk management.

Predictive analytics, an advanced form of data analysis, is a crucial tool for fintech creditors. It aids in identifying consumers who exhibit signs of a possible default, providing an opportunity for preemptive action. Through the application of machine learning algorithms, patterns and trends in vast datasets can be identified, offering insights that can be used to devise tailored repayment plans and prevent potential charge-offs.

Moreover, data analysis can enhance overall portfolio performance by informing the development of risk-scoring models. These models assist in making informed decisions when extending credit, thereby reducing the risk of future charge-offs. Thus, data analysis serves as a powerful tool in charge-off prevention and management, allowing creditors to remain agile and proactive.

2. The importance of early intervention

Swiftly identifying potential risks is an important part of an effective prevention strategy.

Continuous monitoring of repayment behavior is key to this approach. As soon as a consumer displays signs of financial stress – perhaps a missed payment or a sudden dip in credit score – it’s time to initiate an open dialogue.

Engaging with the consumer through their preferred digital channels allows for an understanding of their situation and the exploration of potential solutions. This could involve offering a revised payment plan or suggesting loan restructuring. Keep in mind the uniqueness of each consumer’s circumstances, and ensure the solutions proposed are tailored to their individual needs.

3. Develop a robust collection strategy

Despite preventive measures, some charge-offs are inevitable. When they occur, it’s essential to have a solid collection strategy in place. This strategy should be as diverse as the digital platforms your consumers inhabit.

A comprehensive collection strategy should include digital tools such as email, messaging apps, and AI-driven chatbots. These tools can facilitate regular reminders for repayment and maintain an empathetic line of communication with the consumer. Outsourcing collections to a collection agency, law firm, or master service provider can assist with navigating complex collections requirements and regulations, especially when it comes to digital communications guidelines as detailed in Regulation F of the FDCPA.

While collections may pose challenges, it’s imperative to ensure your strategy is respectful and fair. Treat consumers as individuals dealing with real-world circumstances, not just numbers on a screen. A compassionate approach can encourage repayment, build a positive reputation, and foster long-term customer relationships. Ensure that any outsourced service providers adhere to the same standards you expect of your organization.

4. The option to sell charge-offs

The final strategy on our list might seem like a last resort, but it’s a vital tool in a creditor’s toolkit: selling the charge-off to a certified receivables business. Given the complex financial ecosystem in which fintech creditors operate, sometimes a pragmatist approach is necessary.

When a portfolio of charged-off accounts are sold, fintech creditors can recoup a portion of the lost funds. This might seem like letting go of potential revenue, but it’s important to consider the bigger picture. The sale of charge-offs allows for the immediate injection of capital back into your business. This capital can then be reallocated to more pressing operational areas or invested in growth opportunities rather than extended in collections operations and compliance oversight.

This strategy also saves valuable time and resources that would otherwise be spent on collection efforts. It allows your team to focus on core operational activities, such as approving new loans or improving customer service. In other words, selling charge-offs can free up bandwidth, allowing your institution to better serve its customers and pursue its strategic goals.

However, selecting the right receivables business to purchase your charge-offs is crucial. The chosen firm should be reputable, certified, and uphold the highest compliance standards. The sale of charge-offs is more than just a financial transaction; it’s a transfer of responsibility. Ensuring the chosen firm will treat your consumers fairly and respectfully should be a priority.

Turn the challenge of charge-offs into opportunities

Navigating charge-offs is a complex but manageable task that calls for strategic foresight and decisive action. By leveraging comprehensive data analysis, implementing early intervention strategies, developing a robust collection process, and considering the sale of charge-offs when necessary, fintech creditors can turn this challenge into an opportunity for resilience and growth.

As the digital era progresses, it’s vital to recognize that the consumers of today are digital natives. They prefer online interactions and expect seamless digital experiences. Fintech creditors must align their strategies with these evolving expectations. By blending the power of technology with a human-centered approach, creditors can effectively manage charge-offs and foster lasting relationships with consumers.

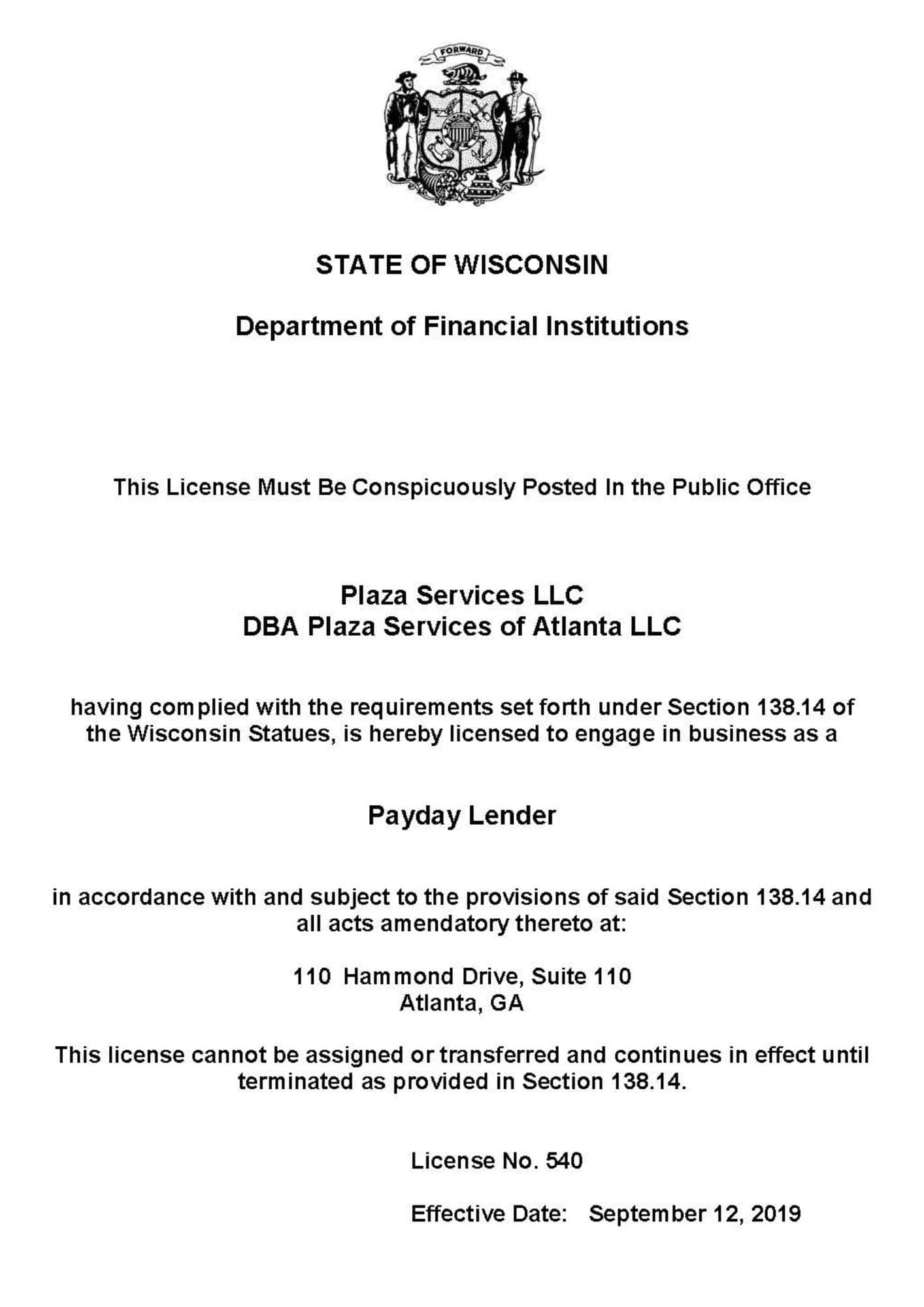

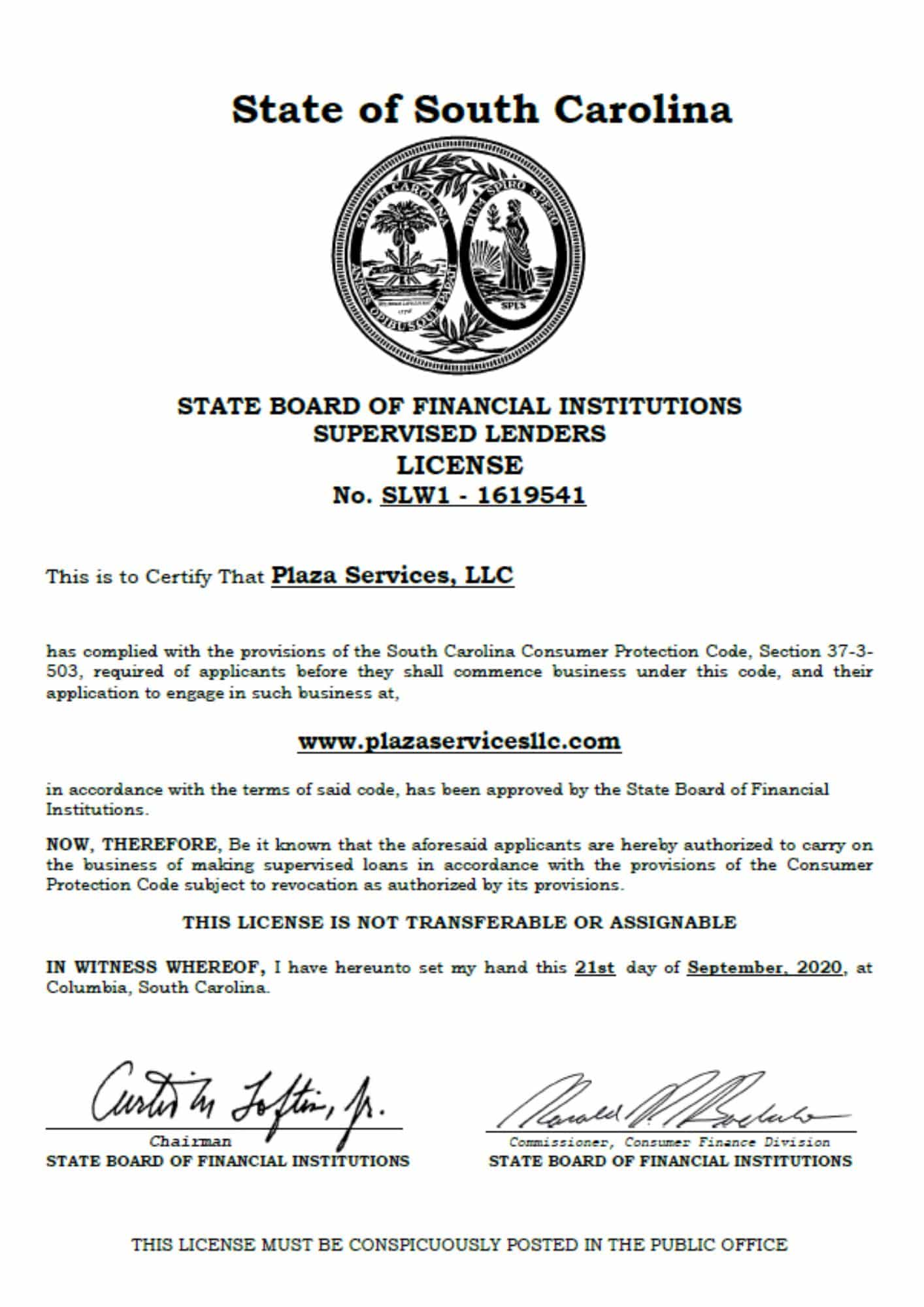

We invite you to explore how Plaza Services, LLC can support you in this endeavor. As a nationally licensed, professional receivables management firm, we specialize in acquiring and servicing consumer and commercial portfolios. We offer quick portfolio evaluations, seamless transaction execution, and clear accountability post-sale. Plus, our SOC 2 certification ensures the utmost security, confidentiality, and safety of consumer information throughout the process.

Tackling charge-offs may be a daunting task, but with careful planning, innovative thinking, and the right partner, it’s a challenge you’re prepared to meet head-on. Together, we can transform the challenge of charge-offs into opportunities.

About Plaza Services, LLC

Plaza Services, LLC is a nationally licensed, professional receivables management firm located in Atlanta, GA. We are a Certified Receivables Business (CRB) by Receivables Management Association International and specialize in the acquisition and servicing of consumer and commercial portfolios. Plaza Services delivers quick portfolio evaluations, seamless transaction execution, and clear accountability after the sale. As a SOC 2 certified receivables management firm, we are committed to the security, confidentiality, and safety of our consumers’ information.